Car Insurance Deductible Ontario

As soon as an insurance company deems you to be a higher risk than other drivers to insure you can expect to see higher insurance. If you are determined to be completely at-fault then you will have to pay the deductible on your Ontario car insurance policy.

Types Of Car Insurance Liability Begin Insurance

Insurance companies differ in the way that they handle claims.

Car insurance deductible ontario. In Ontario the standard deductible offered by insurance companies is 500 for collision and 300 for comprehensive. According to the government report Fair Benefits Fairly Delivered. The stated purpose of this law is to reduce the high auto insurance premiums paid by Ontario residents.

It is about the threat of the damage. Do You Pay A Deductible If You Hit Another Car. The deductible is the amount of an injured persons pain and suffering award that has been stripped away by the Ontario government insurance laws.

On average people can choose from 250 500 or 1000 deductible amounts. Now not everyone can dig out their car insurance bills and deduct the costs from their income. Your insurer determines youre not at fault so they cover the damage to your vehicle under the DCPD section of your policy.

However there are exceptions to this rule. Having damage occur in an accident is bad enough on its own. In provinces where direct compensation exists car insurance in Ontario Quebec Nova Scotia New Brunswick and PEI that section will handle the payout.

However everyone in Canada has to deal with this reality. How much is my car insurance deductible. In order to claim a vehicle-related tax deduction you need to have a company car.

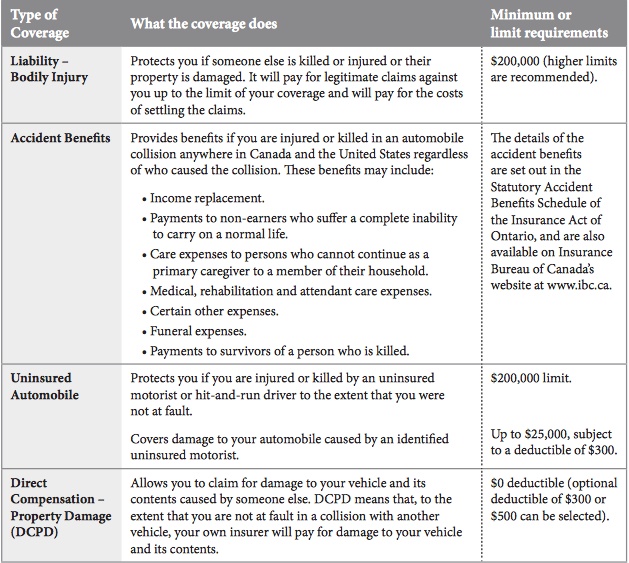

Available coverage is broken down into two categories - mandatory and optional. Each insurance company will set their amounts for this. If you are found driving without valid auto insurance you can have.

Most drivers have a 500 deductible. To be able to do this they. A motorist who doesnt meet these cant deduct costs.

What this means is that the insured has to pay for a part of the damage. The amount may differ according to the specific type of coverage. The amount to pay will vary based on each persons individual policy.

Im Erica Lamont and Im a personal injury lawyer here at Lamont Law in Hamilton OntarioIn this video well be discussing a Hamilton Spect. Any time you make a claim on your home or vehicle insurance youll generally have to pay a deductible. In general when it comes to a write off most will follow a standard process.

The highest deductible for auto insurance in Ontario is approximately 2500. Fines for vehicle owners lessees and drivers who do not carry valid auto insurance can range from 5000 to 50000. Paying for a car insurance deductible is something that no one likes to do.

Why Do Insurance Companies Keep Part of My Settlement as a Deductible. If this is so you cannot claim car insurance because technically it is being paid for by your employer. Basically any time you would need to travel for work as a self-employed person your car insurance is tax deductible.

It is not uncommon for insurance companies to have to handle write off claims. Your DCPD deductible is 0 so theres no deductible for you to pay. How Much Damage to Write Off a Car Ontario.

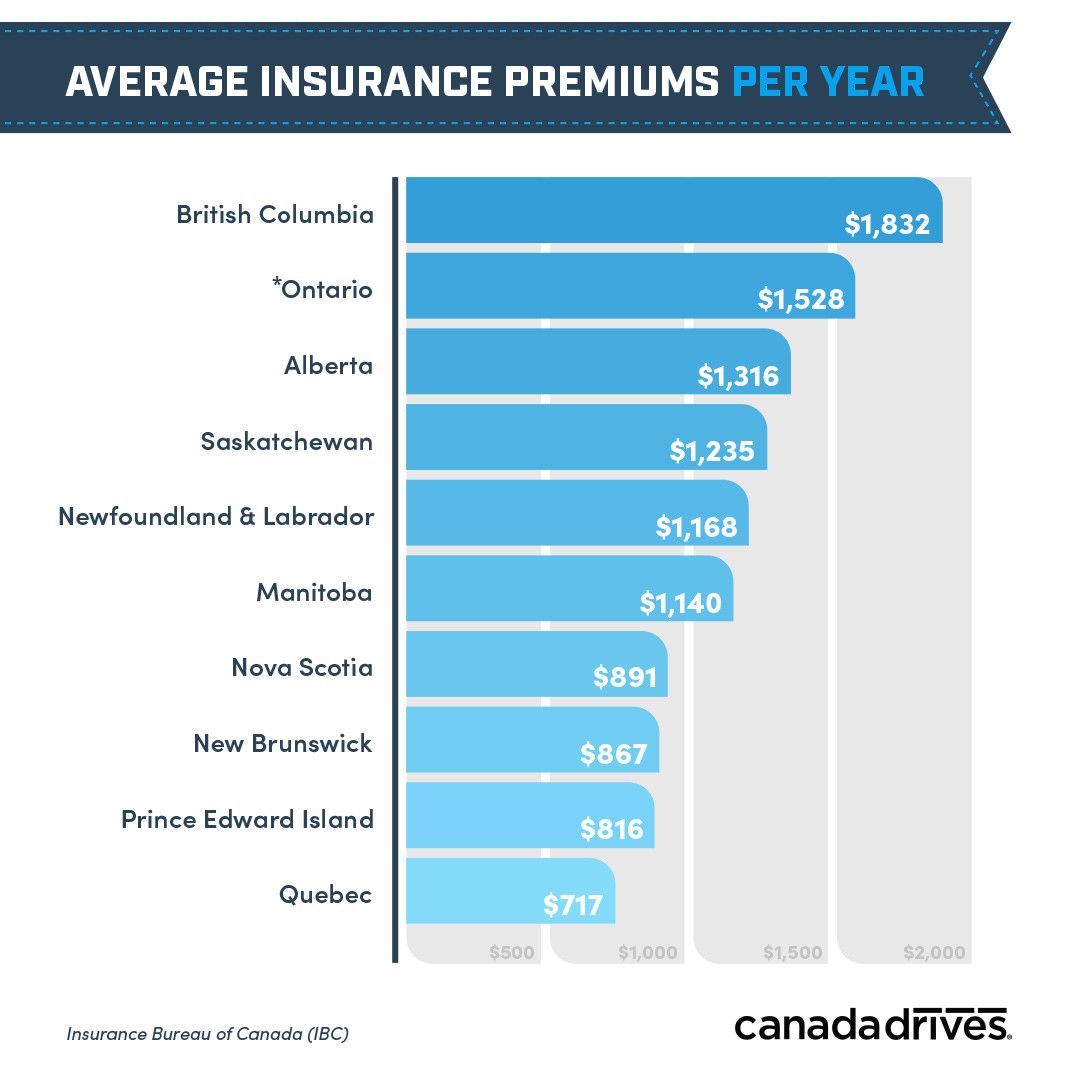

Accident victims simply do not receive the full value of their claims for pain and suffering and loss of enjoyment of life unless the claim exceeds 13251328. A Review of the Auto Insurance System in Ontario individuals in Ontario paid an average auto insurance premium of 1458 per vehicle in 2015. You live in Ontario and another driver rear-ends your vehicle on your way to work.

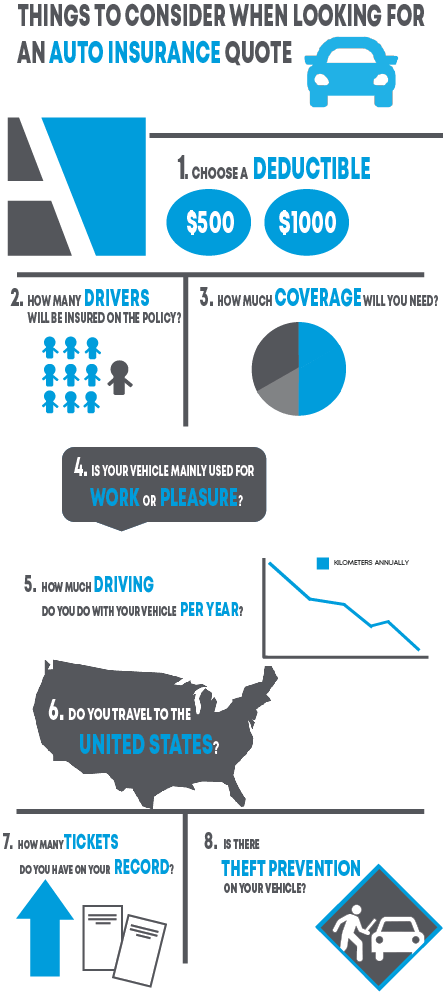

Depending on your insurer you can typically choose a rate from 250 500 1000 or 2000. The damage that comes under the comprehensive insurance coverage. Insurance companies use a set of guidelines called the Fault Determination Rules which are detailed in the Automobile Insurance Act to determine who should be deemed at-fault in a car accident in Ontario.

As a rule deductibles are only waived when you are not at fault and the at-fault persons insurance company agrees to pay your deductible. FSRAO ensures rate increases are substantiated. Just as they handle insurance different according to the provinces.

As with many tax situations there are conditions. Let alone having to pay higher insurance premiums each month and an insurance deductible just to fix up your vehicle. All insurance policies such as auto home renters business and health will have a deductible.

On average most car insurance deductibles fall between 500 and 1000 while most house insurance deductibles fall around 500 to 2000. Ontario auto insurance is provided by private insurance carriers and is regulated by the Financial Services Regulatory Authority of Ontario FSRAO. If you make a claim after an automobile collision for example then the deductible youre responsible for paying may be determined by whether you were.

Under certain circumstances car insurance costs are deducted from employment earnings. Ontario is a busy province with a lot of insured drivers. How Do I Get My Deductible Waived.

Ontario law requires that all motorists have auto insurance. If they ask the choice is yours your car insurance deductible is a financial decision. For this type of insurance the insurance companies will ask for a deductible.

Whats more if the value of the pain and suffering claim does not exceed the deductible the injured.

How To Choose Your Auto Insurance Deductibles Ratesdotca

When Is Car Insurance Tax Deductible Valuepenguin

How To Decide Auto Insurance Deductible Pace Law Firm

Insurance Archives Canadian Budget Binder

Car Insurance Faq For Ontario Budds Chev

When Do You Pay Deductible Car Insurance

Major Mistake To Avoid While Car Insurance Deductible

Car Insurance Broker Ontario All Risks Insurance Brokers

When Do You Pay The Deductible On Your Car Insurance Policy Insurancehotline Com

Do Drivers Who Ve Had An Accident Select Higher Car Insurance Deductibles Ratesdotca

Is Car Insurance Tax Deductible W B White Insurance Ltd

What Is An Auto Insurance Deductible Begin Insurance

What Is A Car Insurance Deductible Bankrate

Understanding Auto Insurance Deductibles When They Apply How They Affect Rates Insurancehotline Com

What Is An Insurance Deductible And How Does It Affect You

13 Ways To Get Cheap Car Insurance

What Is Deductible Car Insurance Learn Everything Here

Taking The Stress Out Of Deductibles The Simple Truth Insurancehotline Com

Which Drivers Are Choosing Higher Auto Insurance Deductibles Insurancehotline Com

Post a Comment for "Car Insurance Deductible Ontario"