1000 Deductible Car Insurance Meaning

For example if you have a deductible of 1000 and you have an. 12 hours agoA car insurance deductible is the amount of money a policyholder pays out of pocket in the event of an accident or other claim.

What Is An Auto Insurance Deductible How Does It Work We Explain It

On the other hand if you had collision coverage with a 500 deductible your insurer would reimburse you for 1000 covered repairs minus your deductible.

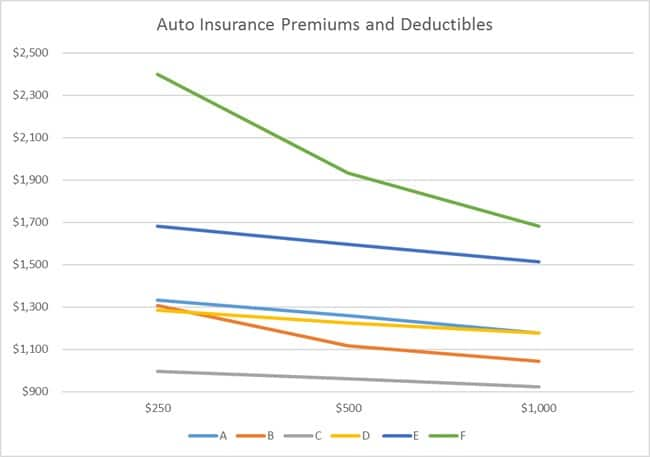

1000 deductible car insurance meaning. If a policyholder chooses a deductible worth 1. Lower deductible Higher car insurance rate and lower out-of-pocket. Generally the higher your deductible the lower your yearly payment.

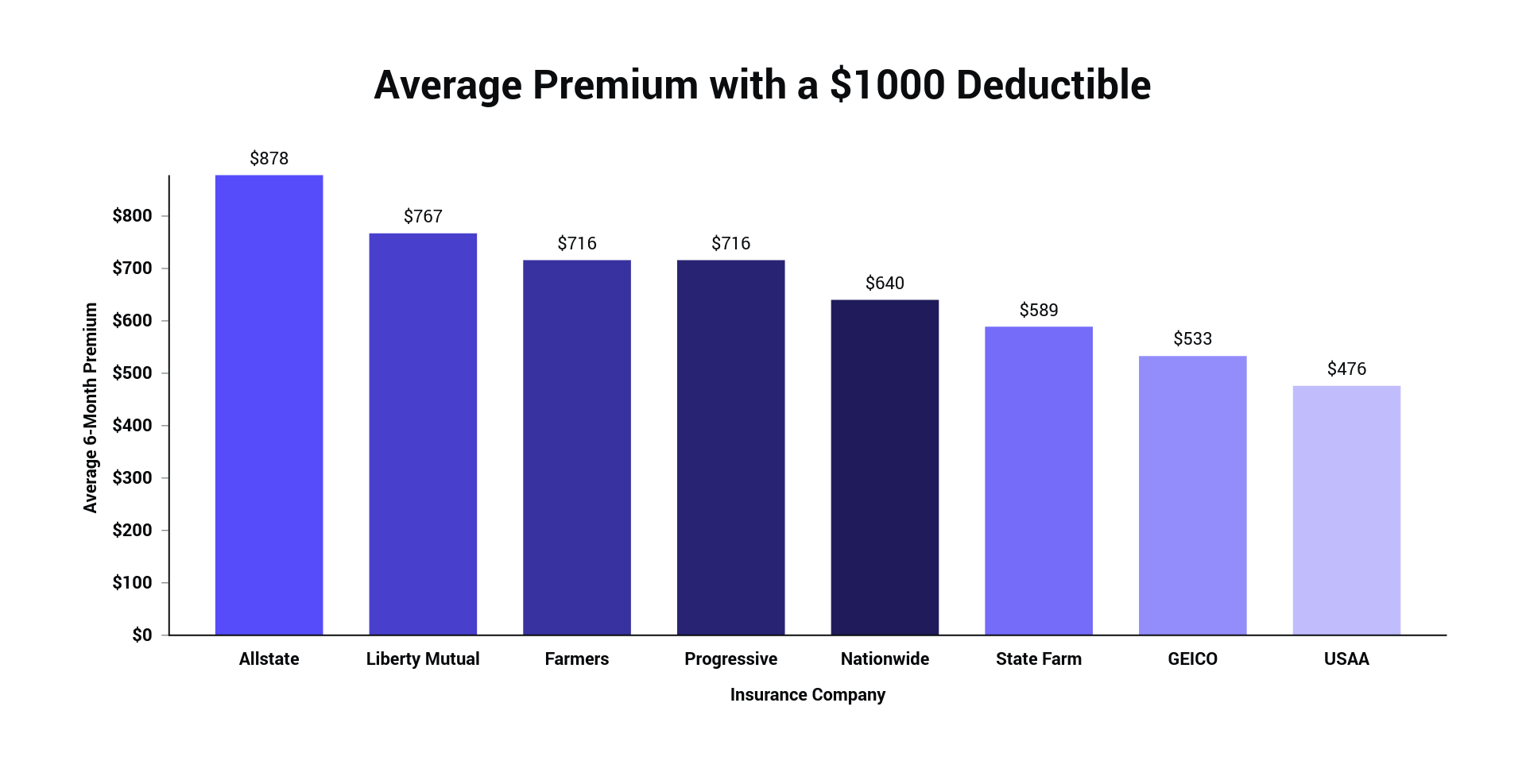

So the reason a 1000 car insurance deductible makes sense is that if the damage were any less you wouldnt be filing a claim anyway. If you have a 1000 deductible on any type of insurance that means you must spend at least that amount out-of-pocket before your insurance company begins to pick up some of the tab. The average six-month premium for a car insurance policy with a 1000 deductible is 664 with USAA being the cheapest company.

Therefore if the policyholders claim amount is at 7500 the policyholder will have to pay the first 1000 and the insurance company will pay the remaining 6500. The deductible is the amount of money you agreed to pay up front for repairs before the insurance company kicks in to pay for the rest. Ultimately it comes down to what you prefer.

If you total a brand new car that could mean a loss of thousands of dollars. When you file a claim against your auto insurance policy youll often have to pay a set amount up-front before your insurance kicks in called a deductible. Car insurance deductibles and premiums are inversely related if you lower your deductible you raise your premium.

When the insurance company determines how much the claim will pay the company looks at the actual damages to your vehicle or your property. Note that if a coverage on your car insurance policy has a deductible this amount will apply each time you file a claim. For example if you have a 500 deductible and file a claim for 2000 you pay the first 500 and your insurer pays the remaining 1500.

1000 is the perfect car insurance deductible because its not enough to make you go broke because you should have the amount in savings which we do but its enough that if you actually do need to file a claim you probably will because anything. Deductibles are usually a specific dollar amount but they can also be a percentage of the total amount of insurance on the policy. For example if a car incurs 5000 worth of damage in a covered accident and the driver has a 1000 deductible they would pay 1000.

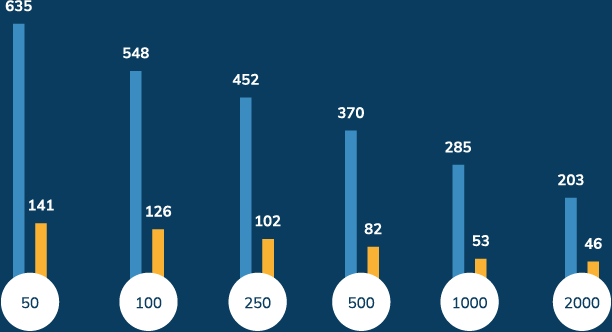

Practically all types of insurance contain deductibles although amounts vary. Car insurance deductible amounts typically range from 100 to 2000. Read More How Do Car Insurance Deductibles Work.

For example if you have a 1000 deductible on your car for collision insurance and the bill to repair the vehicle comes to 4000 the insurance company will only pay 3000 on it. The Pros and Cons of a Low Car Insurance Deductible Having a low car insurance deductible gives you peace of mind especially if youre on a tight budget. How do deductibles work.

This has to occur before insurance pays the costs of damages. If your finances would be seriously rocked by an unexpected 500 or 1000 expense play it safe and opt for a low deductible such as 250. For example one day you are driving along a main road and stop at a red light.

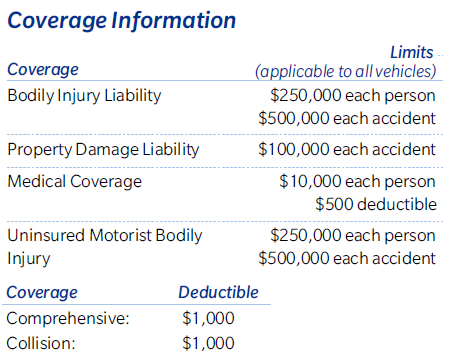

For example you could choose a 500 deductible for comprehensive insurance which tends to have lower premiums but. Lets say if you have a vehicle over 10 years old you may not want to carry a 1000 deductible because the vehicle value is likely within a few thousand dollars. 53 rows The portions of a policy that carry a deductible are two optional coverages.

A deductible is the amount you pay out of pocket when you make a claim. If you have an insurance policy with a 1000 deductible that means you pay the first 1000 and the insurance company pays the rest. Compared to a 500 deductible this could save you more than 170 per year.

Higher deductible Lower car insurance rate and higher out-of-pocket costs. If your deductible is 500-1000 a collision deductible waiver can save you a lot of money especially if you have more than one vehicle on your policy. Car insurance deductibles work the same way for all coverage types and you will get to choose your deductible amount for each.

Comprehensive and collision insurance mean your car will be covered in the event of a total loss but receiving the ACV of your car may not be enough for you to fully replace it with a similar vehicle. For example if a policyholder chooses a deductible worth 1000 this means that amount will have to be paid towards an accident or claim before the insurance kicks in. By reviewing your insurance or contacting your insurer you can confirm how much of a deductible you carry.

The most common deductible our drivers choose is 500 but theres no wrong choice.

Should I Have A 500 Or 1000 Auto Insurance Deductible Insuramatch

What Is 100 300 Insurance Coverage Paradiso Insurance

Best Car Insurance With A 1 000 Deductible The Zebra

The Appropriate Insurance Deductible Insurance Shark

What Is An Auto Insurance Deductible How Does It Work We Explain It

What Is A Car Insurance Deductible Bankrate

What Is Comprehensive Insurance Best Companies In 2021

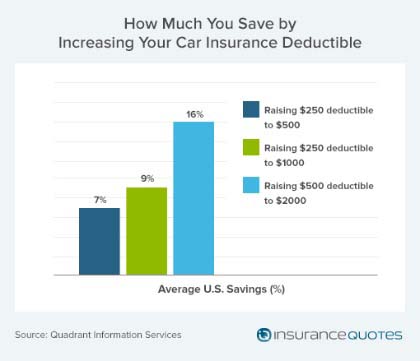

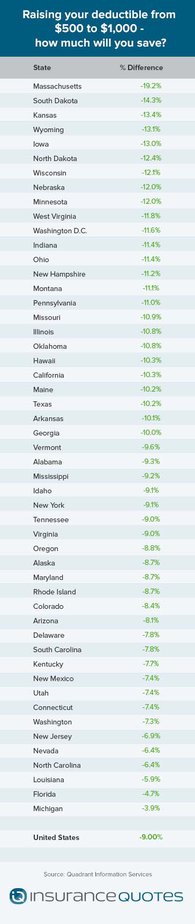

How Much Can You Save By Raising Your Auto Insurance Deductible

How Much Can You Save By Raising Your Auto Insurance Deductible

What Is An Auto Insurance Deductible How Does It Work We Explain It

Auto Insurance Types And Purpose Of Coverage

Car Insurance Deductibles Insurance Com

Should I Have A 500 Or 1000 Auto Insurance Deductible Insuramatch

How Much Can You Save By Raising Your Auto Insurance Deductible

What Is An Insurance Deductible Napkin Finance

What Is An Auto Insurance Deductible How Does It Work We Explain It

How Does Your Car Insurance Deductible Work Insurancequotes

What Is An Auto Insurance Deductible How Does It Work We Explain It

Post a Comment for "1000 Deductible Car Insurance Meaning"